Accounts Receivables

Three months ago, a client with a multimillion-dollar business, proudly showed me the cash reserve he’d built up since our last conversation.

“Look”, he said, “we now have more than 1 month of expenses covered at all times.” “Well, that’s a good start. How could we keep increasing that number?” I responded.

I then looked at his accounts receivable number. I gave a wry smile. He had over 4 months’ worth of operating expenses tied up in receivables.

I opened up his ‘accounts receivable aging summary’ in QuickBooks and, given the look on his face it seemed to be the first time he had seen this particular report. He was shocked that some clients hadn’t paid in over 120 days. “But I know them. They’re good clients”, he exclaimed. “Maybe they’re nice to work with but they don’t pay on time,” I responded.

What’s a vintage table and how to use it?

The ‘accounts receivable aging summary’, or as I more elegantly like to call it a ‘vintage table’, is your friend. It provides you with the clarity you need to see which customer is late paying, by how many days, and what the amount of his/her invoice is. It should be a priority to keep your invoice payments healthy. You should rely on good customers, careful project selection, and clearly defined terms as the primary tools to ensure your receivables are always of a very high quality. It’s good practice to have a portion of operational staff compensation be directly linked to the quality of receivables under his/her management.

Although the vintage table has a lot of great information and is easy to produce in any accounting software, it doesn’t provide everything I like to know. I’ve added a few more tables that will provide additional insight into your accounts receivable and cash management.

Receivable-At-Risk

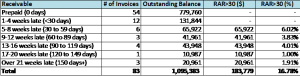

A payment is in arrears when an invoice is due for more than 30 days. The table below shows an example of what the Receivables-At-Risk number is for invoices due more than 30 days. (RAR>30)

What this table doesn’t provide is a means to differentiate the risk of an invoice that is 60 days late and one that is 120 days late. For that we turn to the Receivables Provisioning Table.

Receivables Provisioning

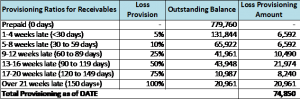

A company should conduct receivables provisioning every quarter to maintain an adequate reserve for doubtful receivables. The reserve is determined by applying predicted loss percentages to aged receivables grouped by lateness of payment.

The loss percentages are determined by the company itself and can vary from industry to industry. In this example, the company calculates a 100% provision for invoices overdue for 21 weeks or more and has a total provision of $74,850. This number is a strong indicator of the total write off it may face at year-end.

Write-offs

Typically, the CEO will make the final decision as to which invoices to write off at year-end. He/she takes into account the age of the outstanding receivable compared to the cost effectiveness of management’s own evaluation of the likelihood of recovery. In this example, the CEO decided that all invoices more than 120 days overdue would be written off, or $31,948 (=$10,987+$20,961) which is 3% of total receivables.

![]()

There are three KPIs to monitor that investors look for with regards to the vintage table. These are:

- A/R at risk>30 days (%) (Example: 16.78%)

- A/R at risk>90 days (%) (Example: 6.92%)

- Value of receivables written off ($) (Example: $31,948)

Note: A/R stands for ‘Accounts Receivable’

Getting paid

Back to my client and his bloated accounts receivable line – what should he do to get paid?

Firstly, he should view it as an opportunity to engage with his customers and to obtain more business with them. Naturally, don’t start any new work unless they pay up-front.

Secondly, he needs to begin all engagements well. This means he must set the payment system up correctly at the start of the sale and make it very clear what the rules of engagement are. No work commences until a fully signed contract has been received and the first invoice has been paid in full as agreed upon verbally and in writing.

Ideally, 100% of the payment is received upfront and you can incentivise for early payment by, for example, providing a 10% discount. If a customer is late paying they must know that they will be charged interest. Although delinquent companies tend to ignore this, you must find a way for it to be enforced. Do you want to work with a customer that doesn’t hold to a legally binding contract?

If you’re unable to receive 100% upfront, try to maximise the % paid before work begins. If they miss payments, stop doing business with them immediately. Not all customers are equal and firing customers is a necessary element of running a successful business. Deposits can be returned and if you’ve provided products make sure the contract states that these still belong to you until you’re paid in full.

As a last resort, threaten not to give them the product or turn them over to a collections agency.

Establishing a no-nonsense reputation will help you long-term attract better customers.

But what if the project is so large that the customer demands a payment plan?

Then make sure that at least 50% is paid upfront and 100% is paid before you finish the project. The customer may have a never-ending list of requests for you to fulfill before they pay their final invoice and the project runs into your future work.

A general rule is to never get paid installments unless the amount is small enough to be put on a credit card, which you run every month. And then it is still a prepayment for your work.

This is a list that can help you get paid in many industries. Naturally, this doesn’t hold for every company in every situation.

Accounts Payables

Our accounts payable is someone else’s accounts receivable, so the majority of any headaches lie elsewhere. However, when we pay our vendors and service providers can have a large impact on the company’s cash flow. Ideally, we want to match the timing of our payments with when we receive cash from our invoices. If we pay vendors too quickly we may run out of cash. Paying too slowly may strain relationships and we want very strong relationships with vendors in case of a cash crunch. Having the ability to ask for extended payment terms from say 30 to 60 days can provide the company some much-needed breathing room.