Don’t just accept challenges, embrace them!

Whenever we employ a new member of staff, I like to set expectations by saying, “Welcome to a rollercoaster ride… When you work here, the only constant you can expect is change!”

Thing is, we all start out in business with ambitions, no expectations, of growth… yet growth cannot possibly occur without change. Ironically enough, when it arrives the sudden surge can cause a company to falter or even fail.

For example, while our businesses are small, we can normally take care of the day to day routines. But as growth appears our staff and management often lack the experience needed to meet the challenges of that growth.

To add to their burden, if success is rapid, our teams are almost always operating with limited resources.

The difficulty throughout this process is that we can rarely afford suitably qualified staff until we reach a certain level, so we often continue to utilise the same staff we had when the business was much smaller which can cause numerous difficulties.

To use a sporting analogy, rarely does a football team who enters the Premiership have the same players that it had when they were playing in lower divisions.

The 8 Success Inhibitors … and what you need to do to overcome them

Research has identified eight major challenges that a company must overcome as it grows.

#1 – Lack of Capital

Lack of capital is often the most critical challenge that a growing business will face so careful cash management is critical.

Even with rapid growth, it’s not often that the profit we make can be converted into cash quickly enough to provide the extra working capital required for the next operating cycle.

This is especially the case where a business is either stock or receivables intensive and/or the operating cycle is a long one. The operating cycle is the average time that it takes from stock arriving to when the customer pays for the goods you’ve sold.

This can be made even worse where the business needs to invest in machinery or equipment to facilitate your growth and can’t finance the acquisition of these assets.

Even the most capable entrepreneurs can find difficulties overcoming the obstacles in their cash flow cycle because they don’t have the security to support the borrowing they need. So, the banks and other lenders won’t provide the financing!

However, the solution is often easier than we realise. It starts with a plan to see what your cash needs are and when they are likely to change. In other words, a Cash Flow Forecast (CFF). Clarity on this will help you to focus on the cash management techniques most likely to be successful in your business.

What will you sell and when? When will you get paid for the goods or services you sell? Who do you owe money to? When must you pay them?

“You cannot manage what you do not measure”

By just creating a simple rolling spreadsheet that breaks the answers to these questions down monthly you can see the gap between what’s coming in and what’s going out… the solution may then be a little creativity in how quickly you can get paid and how long you can take to pay your creditors!

#2 – Lack of Management Skills

Lack of management skills is a problem that is very difficult to deal with in most SMEs as lack of finance can limit the size of the senior management team. These areas of weakness may be across your business, finance, human resources, marketing, operations… any area where the current management does not have the expertise, or the time to deal with the issues.

You must determine where those areas of weakness are and then develop a plan for dealing with those challenges. Once you spend the time to recognise a weakness, as long as it is not in a core area for the specific business, it can often be compensated for without a lot of time, effort or money.

If time is tight, consider getting an existing manager to watch for the obvious pitfalls, or even hiring a person part-time or a consultant.

#3 – Lack of information about what is – and isn’t – working

Lack of information about what’s working in the business and what isn’t can be a huge issue.

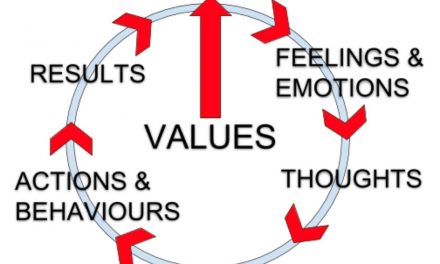

When we fail to measure results, we rarely understand what might have caused a change in those results, whether they’ve gone up or down.

Implementing a process for measuring and tracking key performance indicators (KPIs) on a regular basis is key to enabling management to react to challenges and opportunities alike. What you measure will dictate the frequency by which you measure it.

Consider daily, weekly, monthly and annual KPI’s and remember, the old saying “You cannot manage what you do not measure”, is so very, very true.

If nothing else, it often alerts you to a change from the norm much sooner than waiting until you otherwise become aware of it. Once awareness is established, solutions are easier to find.

#4 – Lack of a Plan

The arguments for planning are many and irrefutable and yet this is a very common failing for most SME’s, even those that are enjoying very rapid growth.

The lack of planning is often a fundamental problem for many SMEs… A great friend of mine once told me, “A failure to plan is a plan to fail”. It’s stuck with me ever since. Yet for some damn reason, I seem to rebel completely from this when it comes to my home life! J

In my opinion, there are three very fundamental reasons for implementing a planning process:

- If your plan sets out certain objectives, you are much more likely to achieve – or exceed them than if you just keep barrelling along regardless. Research has often shown this to be true and it stands to reason that having a plan will enable you to often think through and implement the steps necessary to achieve that plan

- Most SMEs spend so much time dealing with the “alligators” that are snapping at their rear end that it’s difficult to recognise the steps necessary to achieve your long-term objectives. A plan disciplines you to look “beyond the weeds” from time to time

- A plan can often alert you to inconsistencies that need to be managed e.g. a lack of capital or other resources necessary to fund the growth projected. Once you recognise it, you are in a position to better manage the limiting factor

#5 – Poor Procedures

Poor procedures are a constant challenge for any business owner trying to manage with limited resources. Most don’t realise that the procedures in place for managing the business need to be well designed to reduce the incidence of errors. Error correction is often a major waste of time and particularly management time.

Good procedures with a little time and effort invested up front will usually pay enormous dividends in time and cost savings on an ongoing basis.

#6 – Ignoring risks in their assessment of alternatives and opportunities

A business is about taking managed risks and, as business owners simply can’t insure against, or avoid risk if they are to grow. However, once they have chosen a course of action, very few pause to consciously think of ways to determine procedures or steps that can be taken to reduce the risk or manage the risk and increase the chances of success.

Some examples of this are as simple as “diarising” to follow-up on an issue so that it doesn’t get forgotten or having a second person review something to reduce the risk of error.

#7 – Lack of Focus

Entrepreneurs experience constant changes in priorities, issues that need attention and other fires to be extinguished. Often opportunities present themselves and it’s difficult to say “no” to a short-term opportunity that will ultimately distract you from your long-term goals.

Be clear on those long-term objectives and the opportunities that will facilitate you achieving this. Then evaluate other opportunities by the extent to which they draw resources away from your ability to achieve those long-term goals.

#8 – Failure to plan for issues absorbing the majority of your time

Each of the above potential mistakes are common and are often encountered in businesses that could do a lot better. However, the greatest failing that we as entrepreneurs face is not pausing to plan for the issues and solutions that are absorbing so much of our time and energy.

Time is the only thing we spend but cannot buy… consequently, it’s probably the scarcest resource in most businesses. So, a little time developing a strategy can often free up the opportunity to focus on real priorities.

In Conclusion

As entrepreneurs, growth is expected, it’s necessary for a business to not just survive but to thrive.

It’s not possible to experience growth without the associated pain.

So rather than bemoan the pain, become disillusioned or demoralised by it. . . Embrace it. Enjoy it. See it as another opportunity for personal growth, another step on the journey to who you are going to become. . . You may be pleasantly surprised.