Money is rarely our #1 Driver, but essential for success. . .

Not many of us are in it just for the money.

It can be perceived as a cold, ruthless approach when business becomes all about the money, but until you make the budget your company’s #1 priority, you may not be able to fulfil any other priorities.

We have a natural tendency to make optimistic assumptions about our business’s finances, telling ourselves, “we’re busy – we must be making money” or “things will turn around next year”

Until you make this subject a focus that you measure, review and take action on, there’s a very good probability that the money will end up controlling you.

So, it’s one of those parts of business that you cannot afford to ignore so you can focus on the nicer parts like providing excellent customer service or an unbeatable product.

If you run out of cash, these well-placed intentions will unfortunately be impossible to deliver as the business will grind to a very quick halt.

Or more commonly, the business will drag along the bottom, dipping in and out of overdraft, just managing to pay the bills every month and pay you a meagre wage.

It doesn’t take too many years of this to dampen a person’s spirits and make them second guess why they’re doing it in the first place.

You owe it to yourself and your customers to be healthy and profitable, so you’re there year after year when they need you or want to refer you to a friend because they had such a great experience dealing with you.

So, accepting this as a necessary part of the process is the first step toward YOU controlling your finances and not the finances running your life.

Having a budget that means something to you, to achieve a life goal is essential or the chances are it will just be another spreadsheet.

Your budget should be the focus of your strategy and monthly reviews and will help you foresee upcoming problems as they happen, and also re-adjust your strategy at regular intervals.

Having a budget to follow helps remove doubt and fear and replaces those emotions with financial confidence and security.

Getting Started

If you have 12 month’s figures to work with, building the following years budget should be fairly simple.

You will need some simple spreadsheet skills, and some time to go through the past 12 months expenditure and income to work out a plan that you’re going to stick to in the year to come.

If you don’t have any previous figures, you will have to take your best guess and make some predictions.

Start with a target. What do you want to make next year?

What did you make this year, and what is the difference?

Building a budget is all about being able to identify incremental increases and decreases that you can make in your business that will help you close the gap between the reality of your current results, and the target that you want to achieve.

For example, if you were to raise your prices by 10% on a £200,000 turnover, and keep your costs the same, you would add £20,000 to your net profit (also referred as the bottom line).

That could be the difference between making a profit or just making a wage for some people.

If you could also shave off 10% from your supplier costs, let’s say they are £60,000 per year, there’s another £6,000 to add straight to the bottom line.

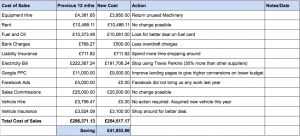

If you can take a 12-month Profit & Loss statement, and import it into a spreadsheet, you can look at each individual account in your business.

So, for example, Fuel & Oil, Rent, Commission, Bank Charges, Insurance, Utility bills, Google or Facebook advertising.

Can you save small percentages on each of those accounts? Ask, “How can I cut 3% from each of those accounts next year?

Making small incremental savings on multiple parts of the business, coupled with a small rise in your prices is by far the easiest way to achieve a significant result on your net profit.

So, look at your 12-month P&L figures and in the column next to the amounts that you spent, put in the amounts that you would like to get down to and then figure out how you could do this.

So, changing a supplier or re-negotiating an existing deal could save you 5%, it’s not too much effort to make that a reality. Doing this with 4 or 5 suppliers will compound into a meaningful amount of money saved.

In the column to the right of the new projected figure, write out your strategy for making this saving a reality and put a date for implementing this task.

Once you have completed this for every line on your P&L, divide the years income and expenditure into 12 monthly columns on a separate tab of your worksheet.

So, you should now have 12 month’s figures of everything you will earn and spend in an easy format.

These figures are your budget forecast or projected figures.

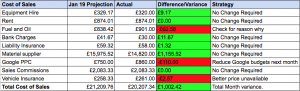

Add a column to the right of each month and put a heading “Actual” at the top.

This is where each month, you enter what you actually spent or earned, and you can add a column to the right of that which can calculate the difference.

This is an easy and simple way of seeing if you met the budget, improved on the figures, or went over budget.

If this is carried out monthly, you’ll get the opportunity to review your plans and either continue successfully or take action to ensure the following month brings better results.

Your spreadsheet software will have some nice functions that will enable you to see improvements in a green cell and areas for improvement in a red cell.

Your budget review every month should take no longer than 90 minutes and shouldn’t be complicated.

So, are you willing to exchange 90 minutes of your time every month to have financial control in your business?

Next edition we’ll be looking at how to predict what future cash we have by using a cashflow forecast tool.