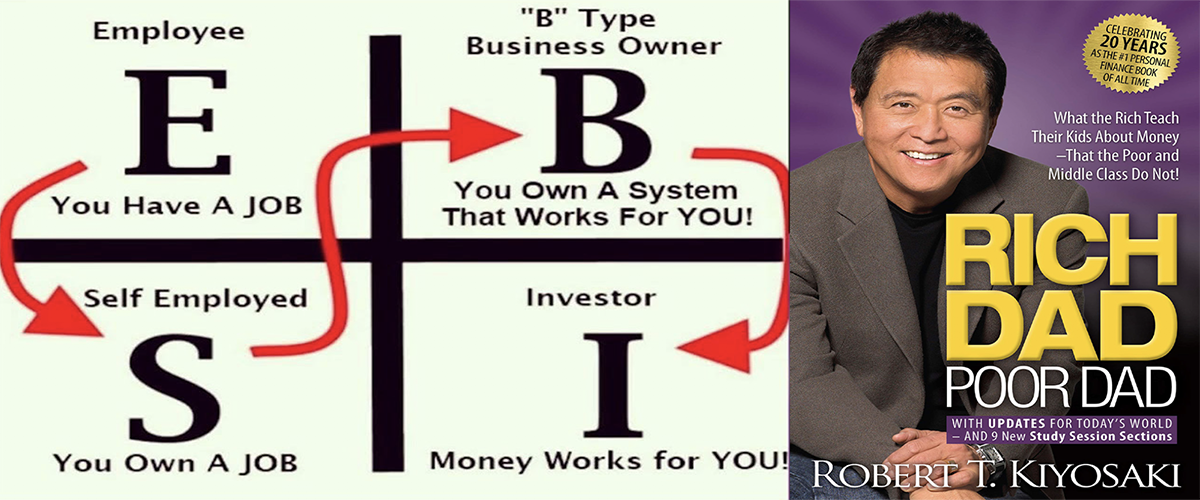

What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Rich Dad Poor Dad (RDPD) is Kiyosaki’s story of growing up with two dads — his real father (poor dad) and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that we need to earn a high income to be rich and explains the difference between working for money and having our money work for us.

Kiyosaki challenges the belief that our house is an asset and says that it’s actually one of the biggest liabilities we have. Buying a house often means working our entire life to pay off a 30-year mortgage and property taxes.

He also explains why we can’t rely on the school system to teach our kids about money. They’re just not taught about subjects like savings or investing, and as a consequence are clueless about topics like compound interest. So here, Kiyosaki teaches us what to teach our kids about money for their future financial success.

However, he also says that this lack of training in financial intelligence is not just only a problem for today’s youth but also for us as highly educated adults, with many of us making poor decisions with our money.

RDPD defines once and for all an asset and a liability, but also explains that we’re only likely to become financially independent once we have a strong financial IQ and a firm, ambitious mind set to support it.

Clearly, society has left us poorly equipped in terms of financial knowledge, and so it is up to us to educate ourselves and Rich Dad Poor Dad is certainly a great place to start and makes some compelling arguments such as;

- Fear of disapproval prevents us from developing wealth

- Fear and greed drive irrational decisions

- Despite being vital to prosperity, we receive no financial training at all

- To become wealthy, we must take educate ourselves, be realistic about our finances and be prepared to risks

- It is a long road and so we must keep ourselves motivated

- Laziness and arrogance can lead even the financially knowledgeable to poverty

- Only invest in assets (which put money INTO your pocket)

- Avoid liabilities (which take money OUT of your pocket)

- Your profession may pay the bills but your business will make you wealthy

- Understand tax laws to minimise your taxes

This is a great book that we would recommend any aspiring entrepreneur should read.

Become a Renegade INNOVATOR and you’ll get your copy of the Renegade Book of the Month in the post, along with many other additional benefits. Find out more by going to http://729renegades.com/innovator/